Investment-Ready Projects: Sustainability and Innovation Focus

The global investment community has undergone a fundamental shift in priorities over the past few years. Institutional investors, venture capitalists, and private equity firms now actively seek projects that combine financial returns with measurable environmental and social impact. This transformation isn't driven by altruism alone it reflects calculated risk management and recognition that sustainable projects often demonstrate stronger long-term performance.

1.Understanding the Current Investment Landscape

The global investment community has undergone a fundamental shift in priorities over the past few years. Institutional investors, venture capitalists, and private equity firms now actively seek projects that combine financial returns with measurable environmental and social impact. This transformation isn't driven by altruism alone it reflects calculated risk management and recognition that sustainable projects often demonstrate stronger long-term performance.

According to recent market data, sustainable investment assets reached approximately $30 trillion globally by early 2024, representing roughly one-third of total managed assets. This figure continues climbing as regulatory frameworks tighten and investor preferences evolve.

What Makes a Project "Investment-Ready"

Investment readiness goes beyond having a good idea. Projects need specific elements in place before serious capital conversations can begin:

Financial fundamentals must be solid. This means detailed financial projections spanning 3-5 years, clear unit economics, realistic revenue models, and transparent cost structures. Investors want to see that management understands cash flow dynamics and has planned for multiple scenarios.

Legal and regulatory compliance cannot be overlooked. Projects need proper corporate structures, intellectual property protection where applicable, and compliance with relevant environmental regulations. This becomes especially critical for sustainability-focused ventures operating across multiple jurisdictions.

Market validation provides confidence. Early customer commitments, pilot program results, letters of intent, or proven demand signals help derisk the investment thesis. Even pre-revenue projects benefit from demonstrating that target customers actively want the solution.

Management teams matter tremendously. Investors back people as much as ideas. Teams need relevant industry experience, technical expertise, and demonstrated ability to execute. Track records of previous exits or successful project completions carry significant weight.

Key Sectors Attracting Sustainable Investment Capital

2.Renewable Energy Infrastructure

Solar, wind, and battery storage projects continue dominating the sustainable investment space. The declining cost of renewable technologies solar panel costs dropped over 90% in the past decade has made these projects increasingly attractive on pure financial metrics.

Large-scale solar farms in emerging markets present particularly compelling opportunities. Projects in India, Southeast Asia, and sub-Saharan Africa combine strong solar resources with rapidly growing electricity demand. Many of these markets have introduced feed-in tariffs and power purchase agreements that provide revenue certainty.

Offshore wind development represents another high-growth area. Countries like the UK, Netherlands, and Taiwan have ambitious offshore wind targets, creating a pipeline of projects requiring billions in capital investment.

3.Circular Economy Ventures

The circular economy concept designing waste out of systems has moved from theory to practical implementation. Investment opportunities span multiple approaches:

Advanced recycling technologies that break down plastics to molecular levels enable true plastic-to-plastic recycling. Chemical recycling companies have raised hundreds of millions in funding as brands commit to using recycled content.

Industrial symbiosis projects connect different industries so one company's waste becomes another's input. These projects often require coordination infrastructure and technology platforms that facilitate material exchanges.

Product-as-a-service models shift business models from selling products to providing services. This approach extends to everything from industrial equipment to consumer electronics, aligning manufacturer incentives with product longevity.

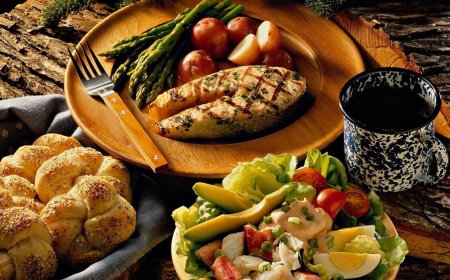

4.Sustainable Agriculture and Food Systems

Agriculture accounts for roughly one-quarter of global greenhouse gas emissions while facing pressure to feed a growing population. This creates massive opportunities for innovation.

Precision agriculture technologies use sensors, drones, and data analytics to optimize inputs like water, fertilizer, and pesticides. These systems reduce environmental impact while improving yields and farmer profitability.

Alternative protein development both plant-based and cultivated meat has attracted billions in investment. While early-stage companies faced challenges in 2023-2024 as funding tightened, the sector continues developing with improved unit economics.

Vertical farming and controlled environment agriculture allow food production closer to urban consumers with dramatically reduced water usage. Projects combining renewable energy with vertical farms present particularly attractive investment profiles.

5.Green Building and Urban Infrastructure

Buildings account for approximately 40% of global energy consumption, making building efficiency and green construction critical decarbonization levers.

Retrofit projects that improve energy efficiency in existing buildings offer stable returns through energy savings. These projects increasingly use Energy Performance Contracting models where returns come directly from measured savings.

Modular construction using sustainable materials reduces waste and construction time. Companies developing cross-laminated timber and other engineered wood products have seen strong investor interest as these materials sequester carbon while replacing concrete and steel.

Smart building management systems that optimize energy usage, indoor air quality, and occupant comfort create ongoing value through operational efficiency. These projects often involve IoT sensors, AI-powered analytics, and integrated control systems.

6.Water Technology and Management

Water scarcity affects over 2 billion people globally, and climate change intensifies water stress in many regions. This creates an urgent need for water infrastructure investment.

Desalination technology has improved significantly, with energy consumption per cubic meter dropping substantially. New membrane technologies and renewable-powered desalination plants make these projects increasingly viable.

Water recycling and treatment systems allow industrial facilities and municipalities to reuse water multiple times. Projects in water-stressed regions like the Middle East, California, and Australia demonstrate strong economics.

Smart water management systems reduce water loss in distribution networks some cities lose 30-50% of water to leaks. Projects that deploy leak detection technology and optimize distribution generate returns through water savings.

Innovation Focus Areas Driving Investment Interest

7.Digital Technologies Enabling Sustainability

Artificial intelligence and machine learning optimize complex systems for environmental performance. Applications range from predicting equipment failures in renewable energy installations to optimizing logistics networks for reduced emissions.

Blockchain technology enables transparency in supply chains, allowing verification of sustainability claims. Projects using blockchain for carbon credit tracking, renewable energy certificates, and supply chain provenance have attracted investment.

Digital twins virtual replicas of physical assets allow testing and optimization before physical implementation. This reduces risk in large infrastructure projects while enabling ongoing performance optimization.

8.Energy Storage and Grid Modernization

Energy storage represents perhaps the most critical enabler of renewable energy adoption. Battery costs have declined roughly 90% since 2010, making storage economically viable for multiple applications.

Utility-scale battery projects provide grid stability services and time-shift renewable generation. These projects increasingly compete with natural gas peaker plants on pure economics.

Long-duration energy storage using technologies like flow batteries, compressed air, or thermal storage addresses the multi-day storage challenge. These emerging technologies need capital for commercialization and first projects.

Grid modernization projects that enable bidirectional power flow, distributed generation, and demand response require substantial investment but create foundational infrastructure for clean energy systems.

8.Carbon Capture and Climate Tech

Direct air capture technology that removes CO2 directly from the atmosphere has progressed from theoretical to operational. Projects combining direct air capture with permanent geological storage or CO2 utilization are raising significant capital.

Industrial carbon capture retrofits for cement, steel, and chemical plants address hard-to-abate sectors. Government incentives like the US 45Q tax credit have improved project economics substantially.

Carbon utilization projects that convert captured CO2 into products like building materials, chemicals, or fuels create revenue streams beyond carbon credits alone.

9.Mobility and Transportation

Electric vehicle charging infrastructure requires massive investment to support EV adoption targets. Projects ranging from highway fast-charging networks to workplace and residential charging present diverse opportunities.

Electric fleet conversion for commercial vehicles offers compelling economics with declining battery costs and rising fuel prices. Last-mile delivery fleets and municipal vehicle conversions demonstrate strong returns.

Sustainable aviation fuel production addresses aviation's decarbonization challenge. While early-stage, SAF projects are attracting investment from airlines, oil companies, and climate-focused funds.

10.Measuring Impact: Metrics That Matter

Investment-ready sustainable projects need clear impact measurement frameworks alongside financial metrics. The impact measurement landscape has matured significantly with standardized approaches emerging.

Carbon metrics provide the most common impact measure. Projects should quantify avoided emissions or carbon removal in tonnes of CO2 equivalent using recognized methodologies. Life cycle assessments that account for embodied emissions provide more complete pictures.

Resource efficiency metrics demonstrate operational improvements. Water savings measured in cubic meters, waste diverted from landfills, or materials recycled provide concrete impact indicators.

Social impact metrics matter for projects affecting communities. Job creation numbers, improvements in energy access, or health outcomes from reduced pollution create measurable social value.

Biodiversity and ecosystem metrics gain importance. Projects affecting land use should measure impacts on biodiversity, ecosystem services, and habitat protection or restoration.

Structuring Deals for Sustainability Projects

Deal structures for sustainable projects have evolved beyond traditional equity and debt to match project characteristics and investor needs.

Project finance structures work well for infrastructure projects with predictable cash flows. These non-recourse or limited-recourse arrangements allow risk allocation among multiple parties while enabling higher leverage ratios.

Blended finance approaches combine concessional capital from development finance institutions with commercial capital to improve risk-return profiles. This structure helps deploy capital in emerging markets or early-stage technologies.

Green bonds and sustainability-linked loans tie financing terms to environmental performance. These instruments have grown explosively, with green bond issuance exceeding $500 billion annually.

Revenue-based financing provides alternative capital structures for projects with strong cash flows but uncertain equity value. This approach has gained traction in efficiency upgrades and distributed energy projects.

11.Risk Management in Sustainable Investments

Sustainable projects face standard investment risks plus specific sustainability-related challenges that require careful management.

Technology risk affects projects deploying new or unproven technologies. Strategies include technology insurance, performance guarantees from suppliers, and staged deployment approaches.

Regulatory and policy risk can dramatically affect project economics. Feed-in tariffs can be reduced, tax incentives can expire, or new regulations can emerge. Diversification across geographies and revenue sources mitigates this risk.

Market risk for commodity-exposed projects requires hedging strategies. Renewable energy projects selling into wholesale markets face price volatility that financial instruments can partially address.

Greenwashing risk poses reputational danger. Projects must substantiate environmental claims with credible third-party verification and transparent reporting.

12.Due Diligence Requirements

Investors conducting due diligence on sustainable projects examine layers beyond standard financial and legal review.

Environmental due diligence assesses actual environmental performance and risks. This includes environmental impact assessments, permits and approvals, potential environmental liabilities, and verification of impact claims.

Technical due diligence validates technology performance, equipment specifications, engineering designs, and construction plans. Independent technical experts typically conduct these assessments for infrastructure projects.

Market due diligence confirms demand assumptions, competitive positioning, and market dynamics. This becomes especially important for projects relying on emerging markets or new technologies.

ESG due diligence examines governance structures, social impacts, and broader sustainability considerations beyond the project's primary environmental focus.

13.Regional Opportunities and Considerations

The European Union leads in sustainable finance regulation with its taxonomy and disclosure requirements. This creates clear frameworks but also compliance requirements. The EU Green Deal has mobilized substantial public and private capital toward climate targets.

United States sustainable investment has accelerated dramatically, driven by Inflation Reduction Act incentives. Tax credits for renewable energy, carbon capture, and clean manufacturing have transformed project economics.

Asia-Pacific presents diverse opportunities. China dominates renewable energy manufacturing and deployment. India has ambitious renewable targets creating massive infrastructure needs. Southeast Asian nations are developing renewable resources while facing energy access challenges.

Latin America offers strong renewable resources, particularly in solar, wind, and hydropower. Projects must navigate varying regulatory environments and sometimes challenging economic conditions.

Africa combines massive infrastructure needs with abundant renewable resources. Projects often require blended finance structures and careful risk management but offer significant impact potential.

Preparing Your Project for Investment

Projects seeking capital should take specific steps to position themselves for investment discussions.

Develop a comprehensive business plan that addresses market opportunity, competitive advantages, financial projections, risk factors, and management team capabilities. This document serves as the foundation for investor discussions.

Build a data room containing financial statements, legal documents, technical specifications, customer contracts, and other relevant materials. Organized information accelerates due diligence.

Establish advisory relationships with experienced board members or advisors who bring relevant expertise and networks. Quality advisors signal project credibility.

Demonstrate traction through pilot results, customer commitments, partnerships, or other validation. Early evidence of market acceptance significantly improves investment prospects.

Understand your valuation based on comparable transactions, discounted cash flow analysis, and market conditions. Realistic valuation expectations facilitate productive negotiations.

14.The Path Forward

Sustainable and innovative projects face unprecedented opportunity as capital flows accelerate toward solutions addressing climate change, resource scarcity, and social challenges. Projects combining strong financial fundamentals with meaningful impact will find receptive investors across multiple asset classes and geographies.

The investment landscape will continue evolving. Regulatory frameworks will tighten disclosure requirements. Impact measurement will become more standardized and rigorous. Technologies will mature and costs will decline. But the fundamental dynamic capital seeking sustainable returns while addressing global challenges will strengthen.

Projects that prepare thoroughly, demonstrate clear value propositions, and maintain realistic assessments of both opportunities and risks will successfully attract the capital necessary to scale their impact.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0