Marriott's Luxury All-Inclusive Trends Shaping Caribbean Travel in 2026

Marriott is expanding its luxury all-inclusive strategy across the Caribbean in 2026 by strengthening its Bonvoy-integrated resort platform and pushing high-end brands into the all-inclusive category. Key luxury labels like JW Marriott, W Hotels, and Luxury Collection are now entering or expanding within the format.

1. Marriott is centralizing an “all-inclusive” offer under Bonvoy while pushing luxury brands into the format

Marriott continues to promote an All-Inclusive by Marriott Bonvoy hub that groups inventory, packages and marketing for multiple resort brands, making it easier for guests and travel agents to find Bonvoy-eligible all-inclusive stays. This positions loyalty integration (points earning/redemption and member benefits) as a core commercial lever for the segment.

2. JW Marriott is moving into the all-inclusive category a clear push upmarket for 2026

Marriott signed an agreement to convert a Costa Rica property into a JW Marriott all-inclusive resort; conversion work began mid-2025 and the property was scheduled to join the Bonvoy portfolio in spring 2026. This marks JW Marriott’s first major step into the all-inclusive model and signals Marriott’s strategy of bringing traditionally “luxury” labels into bundled-stay formats.

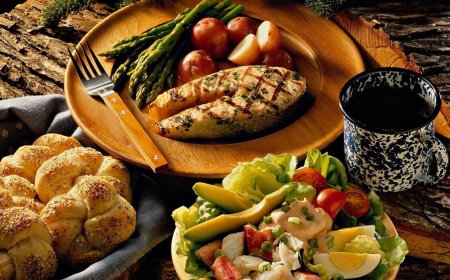

3. W Hotels’ adults-only all-inclusive example shows a lifestyle/luxury playbook for resort design and programming

W Punta Cana opened as W’s first adults-only all-inclusive resort, with programming and amenities designed around lifestyle, music, wellness and design-forward F&B. The W launch illustrates Marriott’s play to segment inventory by traveler purpose (adults/lifestyle vs family) and to price and market those segments differently. Expect more lifestyle/luxury labels to use adults-only or curated programming as a revenue and positioning lever.

4. New brand extensions and conversions scheduled for 2026 expand Marriott’s inventory mix (not just one-off openings)

Beyond single openings, Marriott has multiple projects and conversions timed for 2026 that increase room inventory under premium labels (examples include JW conversion in Costa Rica and new Westin/other branded all-inclusives). These additions change distribution dynamics for Caribbean/LAC travel by shifting more inventory into global chain channels and loyalty distribution.

5. Luxury Collection / Luxury-positioned resorts are appearing on more remote or conservation-oriented islands (product + destination alignment)

Recent launches under Marriott’s Luxury Collection and Luxury-positioned brands show a pattern: resorts sited on smaller, conservation-linked islands or protected areas, combining higher-end services (butler services, curated dining) with destination stewardship and access improvements (e.g., new air routes). This trend ties luxury all-inclusives to premium, lower-density destinations rather than the mass beachfront model.

6. Pricing strategy: higher ADRs, tiered inclusions, and a la carte “luxury” add-ons

Marriott is treating luxury all-inclusive inventory as a higher ADR product with defined tiers of inclusions (standard all-inclusive vs premium packages with private dining, butler service, exclusive excursions). Loyalty benefits (Bonvoy) and brand segmentation allow Marriott to both protect premium rates and cross-sell upgrades. This increases ancillary revenue potential while keeping core F&B/amenities bundled. (Platform and brand launches underpin this approach.)

7. Guest segmentation is explicit: lifestyle adults, multi-generational families, and high-net-worth privacy seekers

Marriott is packaging luxury brands to target clear cohorts: adults-only lifestyle (W), luxury family or multi-generational (Luxury Collection/JW with dedicated family programming or private-suite options), and private-island/remote-resort customers who pay for exclusivity and bespoke experiences. Product and marketing reflect that segmentation in 2026.

8. Distribution: stronger direct sales + retained OTA/tour operator relationships

Marriott is driving bookings through its Bonvoy channels and an All-Inclusive microsite while keeping OTAs and tour operator partnerships active for volume feed and packaged travel. That hybrid distribution keeps Marriott visible to mass channels while capturing higher lifetime value through loyalty on direct bookings.

9. Operational emphasis: local hiring, training, and partner operators to scale service to luxury standards

Large luxury all-inclusive resorts require significant F&B, entertainment and curated-experience staffing. Marriott’s openings and conversions in the region include explicit workforce training plans, use of local operating partners in some markets, and staged staffing models tied to seasonality to maintain brand service levels without unsustainable operating cost spikes.

10. Sustainability and destination integration are now baseline requirements for approvals and for high-spend travellers

New luxury projects cite local sourcing, waste and water management, and community skill development. For luxury all-inclusives, demonstrating measurable sustainability (conservation agreements, local employment targets, reef or coral programs) matters to regulators, partners and a growing segment of higher-spend customers. Expect sustainability KPIs to be part of brand briefs going into 2026 projects.

11. Air access and route development are part of the product play small luxury resorts push for direct flights or planned carrier schedules

Several recent openings show coordinated efforts to improve air access (new seasonal or year-round routes) so higher-end resorts can reliably reach primary feeder markets. This is especially true for small-island Luxury Collection properties where limited supply demands predictable connectivity.

12. What this means for travelers, agencies and destinations in 2026 - practical takeaways

Travelers: more Marriott-branded luxury all-inclusive choices with clear loyalty benefits; expect premium pricing for curated inclusions and adults-only lifestyle product.

Travel advisors: update sell sheets and rate codes for Bonvoy-eligible all-inclusive inventory and be ready to recommend staged upgrades (private dining, butlers, exclusive excursions).

Destination planners: branded luxury all-inclusives bring investment and air-access pressure expect coordination requests on infrastructure, workforce development, and environmental safeguards.

13. Short list of specific launches and milestones to watch in 2026

JW Marriott all-inclusive opening in Costa Rica (spring 2026 conversion).

Westin Playa Vallarta Westin’s all-inclusive resort scheduled to arrive May 1, 2026 (example of established upper-upscale brand moving into all-inclusive delivery).

W Punta Cana’s all-inclusive lifestyle model and subsequent brand extensions or conversions will set a template for future adults-only luxury launches.

1.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0